The Four Phases of a Deal:

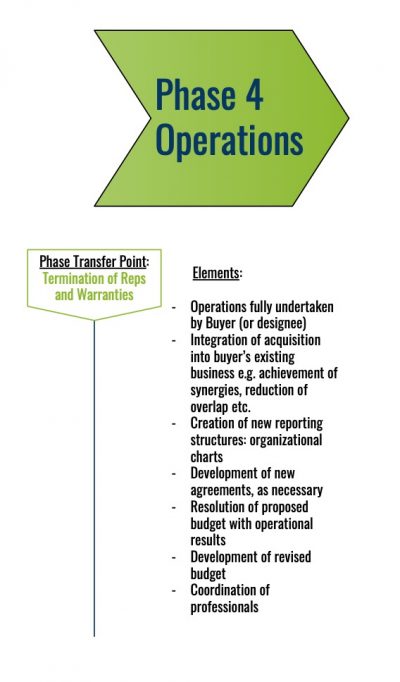

Phase 4; Operations

In Phase IV, the independent operation of the business is fully undertaken by the buyer(s) and the end goals of the underlying deal can be accomplished. Here, the new business is integrated into the buyer’s structure(s), achieving the targeted economies, efficiencies, synergies, and the like. Because this phase involves the least contact (perhaps none at all) between the parties, it is rarely considered part of the deal. Still, though failure here cannot scuttle the deal itself, a lack of continuity through Phase IV can vitiate the deal’s objectives.

Phase IV is nearly impossible to define with any particular detail; it is as unique as the deals themselves. As a result, the most important skill set to bring to this phase is creativity. Common exercises during this phase include: development and creation of new reporting structures, development and creation of new agreements/contracts to serve both new structures and new relationships (with its employees/contractors, as well as third parties), and the resolution of the “deal budget” with the results of actual operations – that is development of a new budget.

With the conclusion of Phase III and its reps and warranties, the buyer no longer has recourse to the seller for anything. By now the seller will have cleared all necessary hurdles and the success of the acquisition belongs exclusively to the buyer. Obviously, planning for Phase IV should have begun long ago – ideally in conjunction with development of an offering acquisition price.

A valuation gap will exist between buyer and seller based on expertise in, as examples, operational management, business development, product development, technology implementation and myriad other factors. This valuation gap will be particularly pronounced when the buyer is strategic (as opposed to financial). [NOTE: a strategic buyer is purchasing with an expectation of operating and generating value from that buyer’s existing assets/skills/economies of scale, whereas a financial buyer is a buyer is a buyer primarily interested in the return on their investment in the business] In this case, the strategic buyer should have previously identified synergistic opportunities and developed a plan to achieve them. Phase IV is where the value of the deal is either recognized or, ultimately, squandered.

The final element of Phase IV is the coordination of professionals, from those who prosecuted the deal to those who will serve the company in its operations. In certain circumstances, these can be the same professionals but, if not, the deal professionals should provide detailed briefings, documents and even future availability to ensure a seamless and efficient “handoff” of responsibility.

Too often, business combinations are sought in lieu of business building – for example, to achieve additional revenue, products, markets, technologies, employees etc. However, and this cannot be sufficiently emphasized, the business building requirements and obligations (fiscal, personal, etc.) of the buyer are greatly increased, rather than absolved, by an acquisition. In other words, purchasing a business is not a “shortcut” to growing existing business, it’s actually the long way around.

For this reason, amongst other practical concerns, in the first three phases of a deal management should focus on achieving a return on investment that (at least) meets its hurdle rate of investment. That way, the operational efforts in Phase IV can be relaxed and focused on generating additional revenue/profit for the buyer rather than trying to remediate a bad deal without the benefit of the transactional protections (e.g. representations and warranties) to assist.