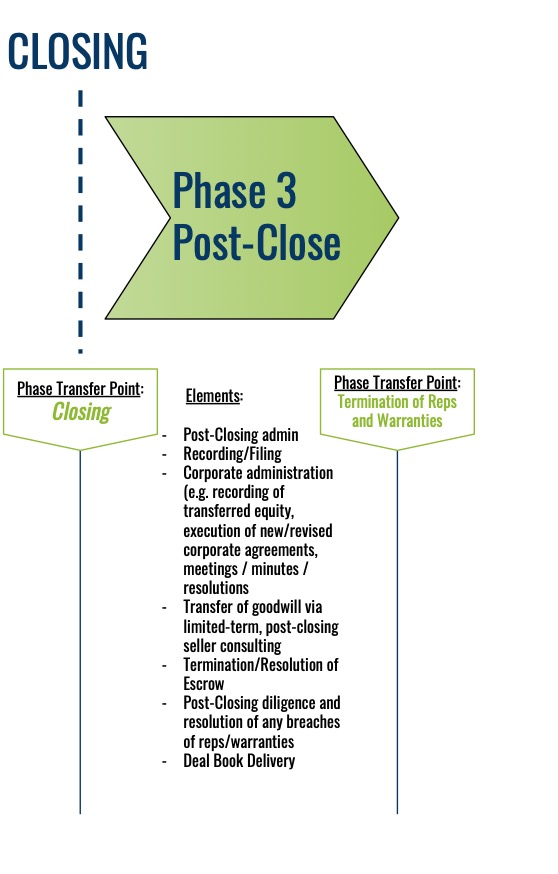

The commonly-overlooked Phase III begins once the dust settles from the closing – i.e. documents are signed, copies distributed, wire transfers cleared, and announcements made. Of course, “mop up duty” is never glamorous, but the success or failure of a deal often relies most heavily on how this important period is managed.

There are some obvious and immediate matters to attend to following the closing, which include the distribution of completed documents to all interested  parties, the closing of escrow and the documentation of new ownership/equity interests in the relevant corporate records. Additionally, there are filings to be made with the relevant authorities at almost every level (e.g. city, county, state, federal, etc.), which may include the transfer of licenses and other authority to new owner(s).

parties, the closing of escrow and the documentation of new ownership/equity interests in the relevant corporate records. Additionally, there are filings to be made with the relevant authorities at almost every level (e.g. city, county, state, federal, etc.), which may include the transfer of licenses and other authority to new owner(s).

Many of these elements are explicit conditions to the completion of the deal and failing to accomplish them can sink the deal just as effectively as failing to sign the documents. Further, there are frequently ministerial corporate items to accomplish for the new owner(s), including electing new managers/directors and officers, noticing and holding corporate meetings, and filing signed minutes and resolutions for the same. These matters are most effectively and efficiently handled by the same counsel that prosecutes the deal, as they have the most knowledge of the deal and the corporate work necessary to accomplish the aims they set out in the deal documentation.

It is important to note that a “sign and close” deal includes a phase that we did not explicitly identify in this four-phase model: the Interstitial Phase. This, occasionally necessary, phase occurs between the execution of the definitive documents and the actual closing of the deal. This phase is usually defined by contract, with outstanding condition(s) precedent to the closing at the time the deal is signed.

The terms of this Interstitial Phase are also defined by contract, and typically include restrictive covenants on the part of the seller to maintain the subject business and/or its assets in saleable state while the necessary condition(s) are resolved. The Interstitial Phase is substantively similar to Phase III inasmuch as it is usually characterized by significant administrative obligations which are typically handled by counsel. The Interstitial Phase feels more like a continuation than a whole new phase of the deal and concludes with the delayed closing, at which point the Interstitial Phase gives way to Post-Closing.

The most important element of Phase III is also the most commonly overlooked – the transfer of goodwill to the buyer(s). Goodwill – an intangible asset – is the value of business’s brand name, good customer relations, extensive customer base, excellent employee relations and any proprietary technology or patents. These assets are not separately identifiable. In a successful business, the whole is greater than the sum of its parts. The difference between the value of the whole and the sum of its parts is the goodwill. Goodwill comprises the nature of the business and the ethics and integrity with which it conducts its business, i.e. the brand itself.

Transferring goodwill to the new owner, in a basic description, involves the introduction of the new owner to customers/clients and key employees by the outgoing owner and is frequently more complex and nuanced. This also commonly includes a “transition/training period” (as codified in the definitive documents) during which the seller(s) remain on-site or is otherwise available to the new owner(s). The successful transfer of this goodwill is essential for a successful transaction and should be prosecuted with the same energy and purpose as the Deal Phase itself.

The remaining element of Phase III is likely the most time intensive and also defines the end of the phase: the resolution of representations and warranties made by the seller(s). For a period defined in the definitive documents, the seller(s) have made promises with respect to the business, the veracity of which is left to the buyer to determine. Because many of these elements cannot be effectively determined during the relatively short period represented by Phases I and II, these representations and warranties survive beyond the closing. The buyer must be diligent in determining whether or not all the promises upon which they relied in making the purchase were, in fact, true.

The discovery and prosecution of these “reps and warranties” can often come as a surprise to the principals, who relied on an overall “good feeling” and who likely even celebrated together following the closing. However, this is another place where good definitive documents, and the lawyers who drafted them, prove their value. The applicable penalties for breaches range from permitted “cures” all the way to recission (i.e. undoing) of the deal and must be handled with an eye on the terms and conditions of the deal from which they arise. There is no one-size-fits-all approach to these breaches, but they absolutely should be handled by the same professionals who drafted/negotiated them both (provided they were effective at doing so) to ensure the efficacy and accuracy of the resolution and the cost-efficiency of the same.

The end of Phase III is the termination of these representations and warranties, or any other outstanding contingencies/liabilities between the buyer and seller and represents the transition from a transactional posture to an operational one.