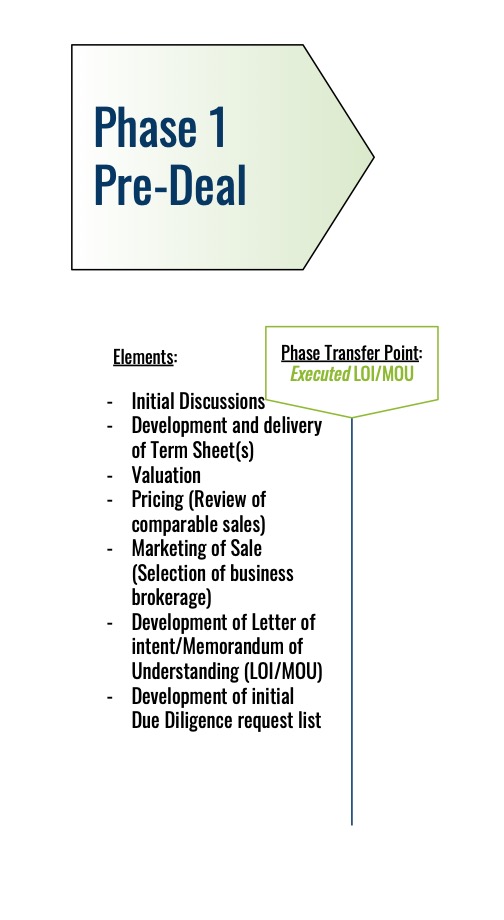

This first phase of the deal concludes with the mutual execution of the Letter of Intent (“LOI”) or Memorandum of Understanding (“MOU”). The commencement of Phase I, like, as we’ll see for Phase IV, doesn’t have a “bright line” identifier. Traditionally, the Pre-Deal Phase starts when principals undertake initial discussions of a potential deal. Alternately, it may begin with contractingwith an investment bank or business broker and developing marketing materials. These marketing materials and efforts are designed to identify and draw buyers into the process.

The informal discussions that follow a buyer’s initial review of marketing materials should move the parties towards developing a high-level “term sheet” which contains the material terms of the deal, including but not limited to:

- Purchase Price;

- Payment Terms;

- Earn Outs,

- Seller Carry,

- Structure (equity or asset deal);

- Exclusivity;

- Timing; and

- Any other elements which are of material interest to either or both parties.

As you might expect, the most important terms are the purchase price and the payment terms. These terms resonate across the entire deal and should be addressed immediately. To assist the negotiation, Phase I should also include a professional valuation or opinion of value. This third-party reference point provides each side with critical information about the purchase price, and also can provide important input on opportunities for the buyer to generate additional value, following the purchase.

A debt provider, such as a bank, will place terms on the loan that set a de facto upper bound of valuation. That is debt service coverage ratios will be breached if the price paid is too high. Notwithstanding this “guard rail”, an overly aggressive price may leave a seller worse off if any of the purchase price is conditional, as is the case with an earn out.

Once the term sheet has been mutually agreed, the parties can develop the formal documentation that memorializes deal terms and the deal process. These come, broadly, in two (2) formats: the Letter of Intent (“LOI”) and the Memorandum of Understanding (“MOU”). They collect and transmit the same information and have the same legal effect, so it comes down to a matter of preference, often that of the business broker and/or the buyer’s counsel, when determining which.

The most important elements of this document are the binding elements, which should be specifically identified and excepted from the blanket declaration  that the balance of the LOI/MOU is not binding. Therefore parties are not bound unless/until the definitive documents are executed. These binding equities typically include confidentiality / non-disclosure (for the terms of the deal and the deal itself), exclusivity, and an earnest money deposit.

that the balance of the LOI/MOU is not binding. Therefore parties are not bound unless/until the definitive documents are executed. These binding equities typically include confidentiality / non-disclosure (for the terms of the deal and the deal itself), exclusivity, and an earnest money deposit.

The LOI/MOU can and should include the opening request for due diligence materials, withholding the right for follow on requests. The LOI/MOU traditionally addresses the timing and scope of this opportunity and provides a non-disclosure provision to protect the confidentiality of these sensitive documents. Alternately, the parties could include a comprehensive list of requested documents, which gives both parties a chance to understand the scope of the diligence effort and get it off to a strong start.

The agreement following the proffer and negotiation of this document concludes this phase and preview the substantive negotiations to come. On balance, parties who struggle with the LOI/MOU, have more trouble with definitive documents, and should adjust their expectations accordingly, not only for ultimate consummation, but also with respect to time and fee budgeting.

If counsel is not retained by this point, this is the time.